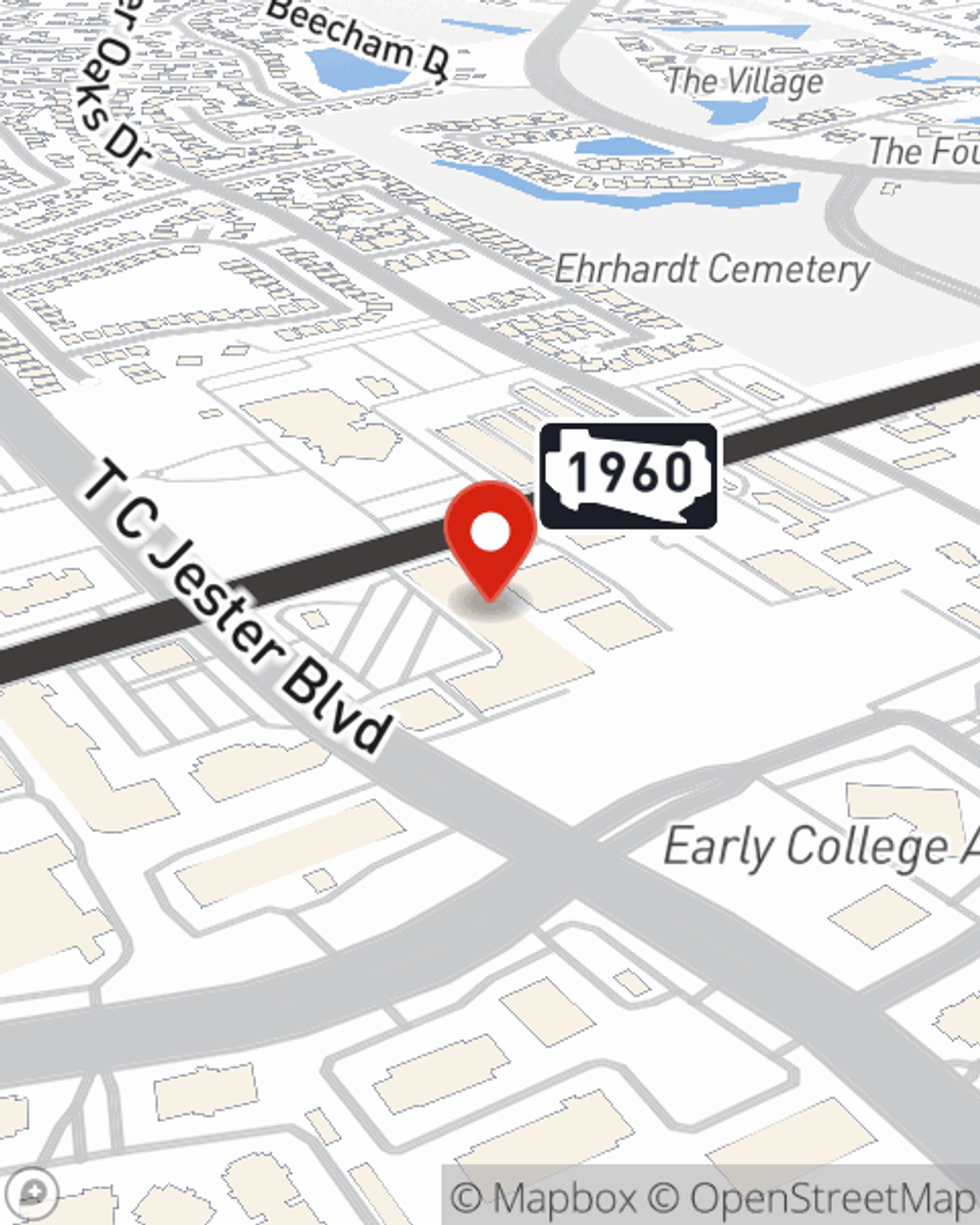

Business Insurance in and around Houston

One of the top small business insurance companies in Houston, and beyond.

This small business insurance is not risky

- SPRING, TX

- NORTH HOUSTON, TX

- HARRIS COUNTY

- MONTGOMERY COUNTY

- HOCKLEY, TX

- WALLER, TX

Help Protect Your Business With State Farm.

Do you feel like there's so much to think about when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Matt Scarbro help you learn about quality business insurance.

One of the top small business insurance companies in Houston, and beyond.

This small business insurance is not risky

Keep Your Business Secure

If you're looking for a business policy that can help cover business property, buildings you own, and more, State Farm may be able to help, just like they've done for other small businesses since 1935.

It's time to visit State Farm agent Matt Scarbro. You'll quickly spot why State Farm is the reliable name for small business insurance.

Simple Insights®

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Matt Scarbro

State Farm® Insurance AgentSimple Insights®

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.